Support Topics

Checking and Savings

FAQs related to our checking and savings accounts.

Popular Questions

-

A POS or “Point of Sale” transaction is a purchase made with your Visa debit card and you are required to enter your PIN on a keypad. POS transactions post to your account immediately. On your statement, a POS transaction will show the amount and the address (and sometimes) the name of the merchant.

-

Our routing number is 323075699.

-

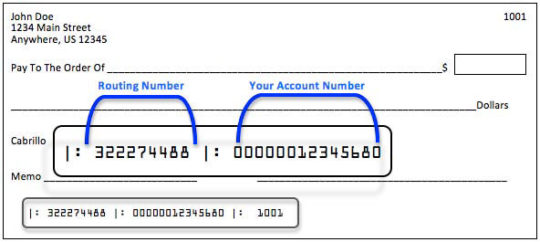

You can find the correctly formatted account number on the bottom of one of your Unitus checks. The first group of numbers on the left is the Unitus routing number. The next group of numbers is your account number.

For direct deposit, you’ll need a 14-digit number. To convert your Unitus checking account number into a correctly formatted 14-digit number, add “1” to the beginning, then add zeros between the “1” and your account number, as needed, to reach 14 digits. Here is an example:

Example account number: 199240616

This account number is 9 digits long, so we’ll add 1 plus four zeros to the front of the number to reach 14 digits: 10000199240616If you have questions, visit a branch or call our contact center at 503-227-5571 or 1-800-452-0900 to obtain the correctly formatted account number for direct deposit.

-

uTransfer is an online tool members can use to transfer money from one institution to another. It is a member-initiated transfer, unlike Online Bill Pay. The member has to set up a withdrawal from another financial institution to deposit into their Unitus account or schedule a withdrawal from their Unitus account to go to another financial institution.

uTransfer is a free service provided to each and every member of Unitus Community Credit Union.

-

Once you log into your account, hover over “Add Account” in the top menu bar, then click on “Go Savings”. The prompts will allow you to deposit funds into your new Go Savings account.

-

Simply put the Unitus ACH routing number and your ACH formatted account number on the authorization form provided to you by your employer or check issuer.

-

Our policy is to make funds from your check deposits available to you on the business day that we receive your deposit. Check holds are placed on a case-by-case basis. If a hold is necessary, funds will generally be available no later than the seventh business day after the day of your deposit. The first $200 of your deposit, however, may be available on the first business day.

Funds from any deposit (cash or checks) made at automated teller machines (ATMs) we do not own or operate may not be available until the fifth business day after the day of your deposit.

-

No. The first $2,499.99 earns the rate in the first tier, the next $2,500-$4,999.99 earns the rate in the second tier, and so on. When interest is paid to the account, the total interest amount is a combination of the amount earned in each tier. Example! If your balance is $25,000, it earns interest like this: $2,499.99 earns 1.98%, the next $2,499.99 earns 0.75% and the remaining $20,000.02 earns 0.25%.

-

Each time you make a debit purchase $5.00 and over, Unitus will reward you with 5¢. Each day your total rewards will be deposited into your Unitus Rewards savings account, which earns interest. You can also elect to round up your debit card purchases to the nearest dollar. That extra change goes right from your Unitus checking account into your Unitus Rewards account each day. You can cash out your rewards at any time, but you cannot make any additional deposits into your Unitus Rewards savings account.

Ready to get started? Log into digital banking and click “add product” under “accounts” or “my offers.” Follow the on-screen instructions to enroll in Unitus Rewards Cash Back or Unitus Rewards Cash Back and Round Up. The Round Up feature is completely optional if you’d like to have your extra change sent from your checking account to your Unitus Rewards savings account. It’ll help you save money faster!

Once enrolled, you’ll see your Unitus Rewards savings account immediately in digital banking and you’ll start earning—and saving—immediately.

-

Yes. We will change them as the market changes.

-

-

This savings is available to Consumer, Business, IRA, and Trust accounts only. ESA and HSA accounts do not qualify.

-

A POS transaction requires that you key the PIN on a keypad at the cash register. It also posts immediately to your account. A VISA check card charge, or debit charge, either generates a receipt for you to sign, or is a transaction done over the phone or online. VISA check card transactions do not post immediately to the account, but the funds from the transaction are on hold (unavailable) until the charge posts.

-

No. It is limited to one Go Savings account per Unitus membership.

-

Yes, it is. The same as our other savings products.

-

Any services you can add to a Prime Share or Special Savings can be added to Go Savings: ACH, Share-to-Share transfers, uOnline access, etc.

-

Unitus offers free overdraft protection transfers from your savings and money market accounts. We also offer overdraft transfers from your Unitus Visa or personal line of credit account, for a small fee, (interest begins to accrue immediately; refer to your loan agreement and disclosure for information regarding loan advances, including repayment terms).

Additionally, we offer an overdraft program on all of our checking accounts (except Right-Choice Checking) called Check Protect. Check Protect is an opt-in courtesy overdraft program that pays checks and debits (except ATM withdrawals) that would overdraw a checking account, up to the account’s Check Protect limit. This is a fee-based service. For additional details please also see our Check Protect Program disclosure.

-

Yes! Your ATM or debit card will allow you to withdraw, deposit or transfer at a Unitus ATM. Just follow the prompts for a savings account.

-

Yes! Open your account in any branch, or online, whichever is easiest for you.

-

We want to help you save – for a new home, a car, retirement. Paying a great rate for a starting balance helps you get started easily. Even if you already have a solid savings plan in place, you will benefit! This stepping stone method of paying interest really works. Plus, this account offers the liquidity of a savings product. If you’re saving for a new home, but an emergency comes up, you can still access the funds and receive a great rate. Remember, there are no penalties for withdrawal.

-

If you earn more than $10 in Unitus Rewards cash back and interest in a calendar year, you’ll receive a 1099-INT form, reporting your interest earnings to the government

-

-

-

If you suspect fraud on your account, immediately contact Unitus. If the suspected fraud involves your VISA check or credit card, you may block the card at any time by calling 1-800-452-0900 or 503-227-5571 and following the prompts for reporting a lost or stolen card. For follow-up purposes, you can call Unitus during regular business hours to complete the report.

-

To add or remove a joint owner on your account, you will need to complete a Membership Application with the updated information. When adding a joint owner to your account, you will also need to have them sign the application and provide proof of ID. The quickest way to add or remove a joint owner is to submit your request within digital banking (desktop or mobile).

- Desktop: Log in to digital banking banking, click “Tools” at the top of page, and then select the “More Services” to get started.

- Mobile: Launch the Unitus mobile app, click “More” at the bottom of the screen, and then select “More Services” to get started.

Additionally, you can get started by visiting our Virtual Branch. To “drop in” during business hours, log in to digital banking and click the “Let’s talk” button near the bottom of your screen; or schedule an appointment with a branch here.

If you need any other assistance, click that same “Let’s talk” bubble to chat with us online or call our member support team at 503-227-5571 and we’ll be here to help.

-

Instant Issue is a service that allows members to replace a lost, stolen or damaged credit/debit card instantly at any Unitus branch.

-

Members in good standing are eligible for Unitus Rewards if they have a Unitus Checking account, debit card, and are opted into eStatements.

-

Yes, you can bring all of your coins into select Unitus branches with a coin machine. Branches that do not have coin machines include: N. Williams, Multnomah Village, and Westmoreland. We have machines that count your coins and then give you a receipt telling you exactly how much all of your coins are worth. Just take that receipt to a friendly Member Advocate and they’ll deposit your money right into your uSavers account! Pretty cool don’t you think?

-

Contact Unitus for forms (please designate the type of IRA, such as a ROTH, Traditional, Coverdell Education Savings or SEP IRA) to be faxed or mailed. You can fax or mail the completed forms back to Unitus. You can also set up direct deposit so that a portion of your deposit goes directly into your IRA. Payroll must be set up on your regular account number and Unitus must have your completed contribution forms prior to setting this up. If you want to change the amount being deposited to your IRA, new forms must be completed. Please note that IRA contributions cannot be retroactive.

-

Don’t worry! Your checking account must have an available balance in order for your purchase to be rounded up. If the money’s not there, we’ll skip the round up for that day!

-

First, you will want to visit a Unitus branch location and talk to a friendly Member Service Representative or MSR.

It’s always a good idea to bring in a piece of ID, like a state-issued ID card or school ID so we can verify your identity and keep you and your money safe. The MSR will deposit your check and give you the cash back. Pretty simple don’t you think?

If you’re thinking of cashing a check it’s always a good idea to have a parent or guardian accompany you.

-

A stop payment can be placed online by calling 1.800.452.0900 or by logging onto uOnline, selecting ‘Services’, then selecting ‘Stop Draft Placement’. There is a fee for placing a stop payment; the fee can be located here.

-

You can monitor the deposits made from cash back and round up in digital banking. Go to Rewards Savings Account Transactions to see your deposits. To see the interest rate, available/current balance, and interest paid year-to-date, just go to the Rewards Savings Account Details screen.

-

-

-

Yes! If there are two debit cards on a Unitus checking account, and the account is enrolled in rewards, purchases from both cards earn cash back and can be rounded up for more savings.

-

DOWNLOAD: Terms & Conditions (PDF)

- Unitus Community Credit Union (UNITUSCCU) provides My Design Card service subject to the following terms and conditions. These terms and conditions are in addition to those found in the Cardholder Agreement governing all use of your Card. The photo, logo, artwork or other Images submitted by you, and all information thereon, are hereafter collectively referred to as the “Image”.

- You certify that you have read and understood the “Photo Guidelines” and that the Image you submitted to UNITUSCCU complies with the Photo Guidelines.

- Fee(s): You agree to pay our standard fees for each card issued with a new image and each card reissued with an existing image. These fees are provided in our Fee Schedule (see Other Service Fees) and will automatically be added to your visa credit card, or deducted from your checking account, depending on which type of card was designed.

- You authorize UNITUSCCU to charge all applicable fees to the card account associated with your My Design Card when your Image is approved.

- In addition to your compliance with the Photo Guidelines, you represent and warrant to UNITUSCCU:

a. The Image you are submitting was created by you and you are the owner of the Image, and/or you have obtained express written consent from the owner of the Image for you to use it on your My Design Card and for UNITUSCCU to alter, copy, print, distribute, prepare and use the Image on your My Design Card;

b. You have obtained the express written consent of any person other than yourself who appears in the Image you are submitting; and

c. Use of the Image will not infringe any businesses or individual person’s rights, including intellectual property, privacy or publicity rights. If UNITUSCCU requests, before or after accepting your Image, you shall provide UNITUSCCU with reasonable proof of such ownership, written consent and/or noninfringement. - You grant to UNITUSCCU a perpetual, non-transferable, non-exclusive, royaltyfree, world-wide, irrevocable license to use the Image and the other data you provide to UNITUSCCU for the purpose of providing your My Design Card.

- You agree to indemnify, defend and hold UNITUSCCU harmless, its affiliates, its card membership organizations and its and their respective shareholders, officers, directors, employees, agents, members, contractors and representatives from any and all claims, liabilities, losses, costs and expenses of any nature whatsoever (including, without limitation, attorney’s fees) that may arise from the issuance or use of the My Design Card with your submitted Image on it, including (without limitation) any and all claims alleging trademark or copyright infringement, and/or the violation of a right of privacy or publicity or any other right.

- UNITUSCCU’s liability hereunder is limited to refunding any fee associated with the issuance of a My Design Card, and UNITUSCCU is not liable to you for any loss, damage, claim or expense whatsoever in relation to any action or omission by UNITUSCCU in connection with the My Design Card service or product. UNITUSCCU is not responsible for poor-quality Images or Images poorly positioned on the My Design Card template. Images and copies thereof shall not be returned to you for any reason.

- Your My Design Card remains the property of UNITUSCCU and you agree to immediately return or destroy the card if asked by UNITUSCCU for any reason, or if the account to which your My Design Card is linked is closed.

- Rejected Images, superseded Images, and Images from canceled My Design Cards, accepted Images, and copies thereof, may be stored for any period of time, and may be purged at any time, that UNITUSCCU may choose in its sole discretion.

- If a submitted Image is rejected, UNITUSCCU will notify you by e-mail, without any obligation to justify its decision.

- If a submitted Image is rejected, you can submit a new Image and request a new custom card design.

- UNITUSCCU reserves the right not to accept or use any Image you submit, or to refuse to issue a My Design Card, for any or no reason whatsoever in UNITUSCCU’s sole discretion. See also the separate Photo Guidelines. In addition to the above terms and conditions that apply to all My Design Cards, the following terms and conditions govern My Design Card Business cards.

- Business agrees that only individual(s) they authorize can submit an Image and request issuance of My Design Card business card(s). Business shall protect the security of its logon and other access information, and is responsible for any unauthorized access directly or indirectly gained using such logon or other access information.

- Business Card Issuance Fees: You agree to pay our standard fees for each card issued with a new image and each card reissued with an existing image. These fees are provided in our Fee Schedule and will automatically be added to your visa credit card, or deducted from your checking account, depending on which type of card was designed.

- Upon receipt of your new My Design Card, the business will need to destroy any previously-issued business cards

-

Deposited funds at Unitus are insured with the National Credit Union Administration (NCUA), a US Government Agency. Regular accounts are insured for up to $250,000; IRA accounts are insured separately for up to $250,000. Please contact Member Services for information regarding multiple account holders.

-

It’s an incentive to save; a tool to help you achieve your savings goal faster.

-

You can make a change at any time. Just log in to digital banking and use the “Let’s Talk” bubble at the bottom of the screen to chat with us. You can also contact us via secure message or phone and we’ll be happy to answer any questions or assist in making account changes.

-

Yes, you can bring all of your coins into select Unitus branches with a coin machine. Branches that do not have coin machines include: N. Williams, Multnomah Village, and Westmoreland. We have machines that count your coins and then give you a receipt telling you exactly how much all of your coins are worth. Just take that receipt to a friendly Member Service Representative and they’ll deposit your money right into your uSavers account! Pretty cool don’t you think?

-

Our Federal Tax ID number is 93-0243503.

-

When transferring to another Unitus account and funds are not available to complete the transfer, no transaction will take place and you’ll receive a notification indicating that you do not have sufficient funds in the source account.

When transferring to another financial institution and funds are not available at the time the external transfer is initiated, no transaction will take place and in the history tab you’ll see an ‘NSF’ (Non-Sufficient Funds) notification rather than the ‘Paid’ notification.

If transferring funds from another financial institution and funds are not available to complete the transfer at the time Unitus attempts to access the funds, the other institution may charge you a fee. Please check with the other financial institution for details.

-

You may not yet meet all the eligibility criteria to enroll in Unitus Rewards. You need a Unitus Checking account, debit card, and must be enrolled in eStatements. If you’re not eligible, you will receive an error message. But don’t worry! You can contact us and we’ll help you set up the right tools to make you eligible for Unitus Rewards.

You may also receive an error message if you already have an account enrolled in Unitus Rewards. In addition, if you try to transfer any funds into this account, you’ll receive an error message as only cash back or round up deposits can be made into Unitus Rewards savings accounts. You may transfer your money out of your Unitus Rewards savings account at any time.

-

That’s simple! It means you’re interested in learning about money and Unitus is here to help you. You can learn through stories about smart ways to spend, tips on how to save and share your money, and play all kinds of fun games!

-

-

-

Unfortunately, Business Checking accounts and debit cards are not part of Unitus Rewards, only Unitus consumer memberships are eligible for Unitus Rewards. To be eligible, members must be in good standing, have a Unitus Checking account with debit card, and opt into eStatements.

-

If a check is returned due to non-sufficient funds, a $30 fee is assessed. The processing institution may present the check a second time (depending on their policy). Please note that not all financial institutions present checks twice.

-

Yes, Unitus does help kids go to school. Unitus offers savings accounts like your uSavers account where you and your family can put money away for school expenses or even college some day.

We also offer educational IRAs that your parents or grandparents can open to get you on a savings path for your educational future. Plus, when you’re a little older, we give away $1,000 scholarships to high school and college students.

-

This is called interest. When you opened your uSavers savings account you immediately began earning interest on the money you put in. The more money you save, the more interest you’ll receive.

-

Contact Unitus for forms to be faxed or mailed to you. Once completed, you can fax or mail back the form to us. If you live in Oregon, a State Tax Withholding form will be sent in addition to the forms. If you do not live in Oregon, we will not withhold state tax from your withdrawal. The standard Federal Tax amount that is withheld is 10% of the withdrawal (or more if desired).

-

To add or remove a joint owner on your account, you will need to complete a Membership Application with the updated information. Please call or email us to receive a membership application.

When adding a joint owner to your account, you will also need to have them sign the application and provide proof of ID. Be sure to make a copy of the front and back of your ID!

Then simply mail or fax the application back to us at Unitus Community Credit Union, PO Box 1937, Portland, Oregon 97207-1937 or fax us at (503) 423-8345.

-

With Unitus’ My Design Card, you can design your own debit or credit card, complete with a personal picture that tells your story. The process is simple, the options are many, and the result is uniquely you.

-

Credit unions and banks are both financial institutions. But a credit union is “not for profit,” and is owned by the members. This means you are part owner of the credit union, and your money is used to help the credit union grow, instead of making a profit for a company or person.

-

Think long and hard…what is that one thing you’ve had your eye on that you really want? A bike? A video game? A really cool jacket? Maybe a pony? Well maybe not a pony. Whatever it may be, you have the power to save your money and buy it.

So when is a good time to start saving? How about right now! Saving your money is easy to do. Talk to a parent or guardian about setting up a weekly savings goal and then deposit your money into your Unitus account. Before you know it you will have saved enough money to buy that special something.

-

If you suspect fraud on your account, immediately contact Unitus. If the suspected fraud involves your VISA check or credit card, you may block the card at any time by calling (800) 452-0900 or (503) 227-5571 and following the prompts for reporting a lost or stolen card. For follow-up purposes, you can call Unitus during regular business hours to complete the report.

-

-

-

A Credit Union is a place where people with common interests, like where they live or work, come together to save and borrow their money.Credit Unions provide many of the same services that banks do, but there are a few things that make us different:

- We are “not for profit”. This simply means we’re not in business just to make money

- Money that we do make is returned to you in the form of better rates and services

- We’re owned by you—the member

- As much as possible, the money we make is spent and put back into the local community where you live

-

It takes a lot of people to manage the day-to-day operations of your credit union. We also have computers that store and protect all our members’ information, including yours. These computers keep track of all the different transactions that take place each day and make sure everyone’s money is in the right place.

-