Home Equity Loans

Think big with Unitus Equity Line Plus! Starting as low as 5.99% APR* get cash on your terms to tackle home projects, make major purchases, pay college tuition, or consolidate debt.

Use our calculator to see how much you could qualify for.

Today's Best Equity Line Plus Rate Options

-

Fixed Rate Segment - For Options 2 & 3

-

Principal & Interest Payment

-

Interest Only

Payment

Home Equity Qualification Calculator

Use this calculator to determine the home equity line amount you may qualify to receive. The loan amount is based on a percentage of the value of your home.

NOTE: Calculators are for illustrative/research purposes only and do not reflect the actual results of any specific loan amount. Please contact Unitus for an accurate calculation.

How Equity Line Plus works

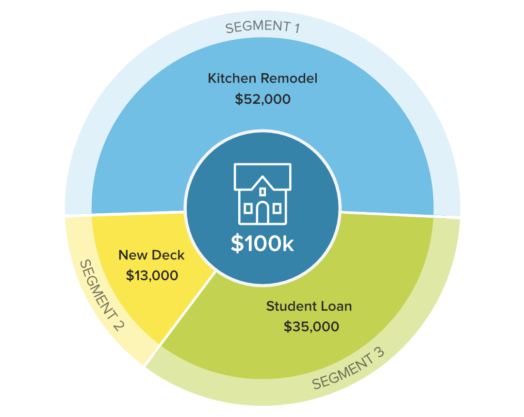

Let’s say you have $100,000 available on your line of credit and you want to pay off a student loan totaling $35,000. We’ll set up a fixed-rate segment1 for $35,000.

When you want to remodel your kitchen for $52,000 and replace your old deck for $13,000, we’ll set up additional segments on your line of credit.

You can create up to five segments on your Equity Line Plus and make one convenient monthly payment. Please contact us to set up your segments.

Benefits that make borrowing simple

-

Borrow only what you need

Free up credit as you make payments, so you can re-draw money as you need.

-

Flexible Credit Line Amounts

Line amounts start at $10,000 to meet your needs.

-

No Interest Until You Withdraw

Easy access to cash, but you don’t pay any interest until you actually withdraw it.

Maximize your borrowing opportunity

- Equity Line Plus allows you to borrow up to 80% of the value of your home2

- You can access cash for unexpected expenses or to pay down high-rate credit card debt

- You make payments and only pay interest on the amount you spend3

- Fixed-rate terms of 60-240 months are available