5 Factors That Decide Your Credit Score

(5 minute read) — As a consumer in our financial system, your credit score is one of the most important parts of your financial well-being. One great thing about your credit score is that it’s not a mystery.

In this article, you’ll learn about the 5 components of your credit score, and how you can check your score for free. Understanding and tracking this little number will help you reach your financial goals.

How does my credit score work?

Simply put, your credit score affects how much you’ll pay for loans. The higher your score, the better rates and terms you will get from lenders. So if you have a higher score, you’re likely to pay lower interest rates, saving you lots of money long-term.

Your credit score can help you meet any goal that requires you to take out a loan. For example, a high credit score can help you save money on:

- A credit card for everyday purchases (such as this rewards card)

- Your first home (so you can stop renting and invest in your own home)

- A line of credit against your current home (to get more out of your house)

- A car, RV, or even a bicycle (to support you in your travels)

How is my credit score calculated?

The good news is your credit score isn’t a mystery. There are two different scoring models: the FICO® Score and the VantageScore. Because Unitus uses VantageScore to make our lending decisions, we’ll use that to review the five factors that make up your credit score:

- Your Payment History. Worth 40% of your score, this is the most important chunk of your score. The best way to maximize this score is to make your payments on time, every time. If you have a history of missed payments, that’s okay too. You can still build your score back up by making payments on time, starting right now. Note that it will take a while for your score to catch up.

- Your Credit Usage. Worth 23% of your score, this is the second most important part of your score. Also called “utilization rate,” this is calculated by dividing your balance by your total credit available. For example, if you have a balance of $600 on a credit card with a $3,000 spending limit, you have a utilization rate of 20% (or 600/3,000). To maximize this score, try to keep this below 30%. Increasing your credit limit (without increasing your spending) helps too.

- Your Credit Age. Worth 21% of your score, this plays a minor role in increasing or decreasing your score. Your length of credit history describes how long you’ve been building credit, so it will be lower for younger borrowers. It also checks how long accounts have been open, so when you open a new credit account, this score will drop slightly. The longer you’ve had accounts, the better your score. It might sound counterintuitive but to maximize this score, keep your credit cards open, rather than closing them.

- Your Total Balance. Worth 11% of your score, this is one of the less important parts of your score. It describes the “mix” of loan types you have. The good news is that most of us will have a good mix naturally. For example, many of us will have a “revolving account” like a credit card, plus an “installment account” like an auto loan, mortgage, or student loan. To maximize this score, open a mix of loan types.

- Your Recent Credit. Worth 5% of your score, this one relates back to the “length of credit history” piece mentioned above. Opening new credit accounts will decrease your credit score temporarily, but not by a lot. Research shows that the most significant risk happens when you open several credit accounts in a short time span. To maximize this score, avoid opening lots of accounts at once, and try to only open new accounts when necessary.

What credit scores are good?

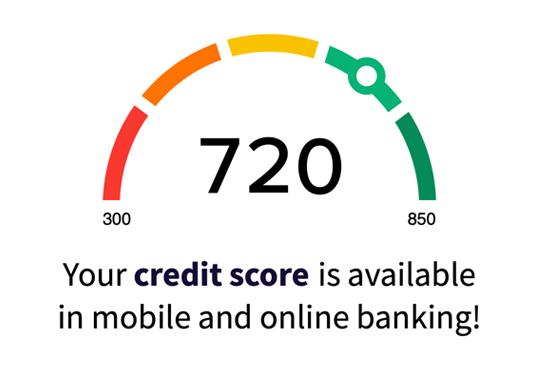

Your credit score can range from 300 to 850. Scores that qualify as “good” will partly depend on the credit scoring model and the lender with whom you’re applying for a loan. But as of the date of publication, you can be sure that a score above 680 is officially considered a “Good” score.

For best results, you’ll need to get your score up to 740 or above. Note that this is not easy; there is a reason this is considered the best of the best. If you can’t hit that mark, don’t worry. A score of 680 or higher will keep you in good company, and will help you earn very good rates on loans.

Why is my credit score going down?

There are a few reasons your score might go down. For example, your score will decrease if any of these are true:

- You miss one or more payments. This is the single biggest reason credit scores decrease. Even one late payment can hurt your score.

- You are maxing out your credit. This spikes your “utilization rate,” which means you are stretching your credit thin. Your score will decrease for this.

- You have opened several new credit accounts recently. Every time you open a new credit account, your score will decrease slightly. But if you open several in a short time period, your score will decrease more sharply.

- You closed one or more older accounts. This one’s counterintuitive for many of us. Isn’t it good to close accounts you’re not using? For organizational purposes, you’re probably right. But from a credit scoring perspective, this could decrease your score because it reduces your “length of credit history.”

- There is a mistake on your credit score. Through no fault of your own, one or more of the credit bureaus might have inaccurate information on your credit report. By federal law, you are allowed to review your report every year for free. Pull your report and review it to make sure there are no mistakes that might be harming your score. Find out how in the section “How do I check my credit score for free?” below.

How do I check my credit score for free?

Each year, by federal law you are allowed to pull your credit report for free. In fact, you can pull three separate credit reports annually for free – one from each of the nationwide credit bureaus:

- Experian

- TransUnion

- Equifax

To pull your report(s), visit annualcreditreport.com. This is the most trustworthy site to pull your reports. Make sure to avoid scam sites who claim to offer your credit score or credit report.

Pulling your reports annually is a great practice. It not only helps ensure your report is accurate and your score is correct. It also shows you exactly why your score is what it is.

Note that these reports usually do not contain your credit score. Some services claim they will show you your score for free, while others allow you to monitor your score for a subscription fee. Before you sign up with one of these free services, carefully review their terms to make sure you’re not giving up more than you’re getting.

One of the most reliable ways to check your score is through your trusty financial institution.

Free Credit Monitoring Now Available for Unitus Members

Unitus offers free credit tracking service for all Unitus members. It’s called “My Credit Score.” It helps you monitor your credit score, improve your score with detailed analysis, and keep more of your hard-earned money. To get started, log into digital banking or our mobile app and click “My Credit Score” from the menu.

As a bonus: The “My Credit Score” feature will not affect your score. We use a “soft credit check,” which means you can take advantage of this feature as often as you like with no impact on your score.

The first step to managing your credit score is knowing what’s in it. Now that you know what makes up your score, you can use this knowledge to improve your score, save more, and reach your financial goals. Don’t forget to check back here in the next few weeks when we’ll focus on exactly how you can start improving your credit score today.

About the author: Jacob Schnee

Jacob joined Unitus as Marketing Specialist in March 2015 and transitioned to Marketing Communications Specialist in March 2017. His experience has spanned hospitality, business development, consulting, and marketing in various industries along the east coast, west coast and in between.

When he is not developing internal and external communications for Unitus, he is engaging in recreational fitness, studying personality types and exploring the outdoors with his wife, dog, and two girls.